NRMA Expert Advice

Web app

Across the board, small business owners are critically underinsured. But we know that people won’t purchase something that they don’t understand.

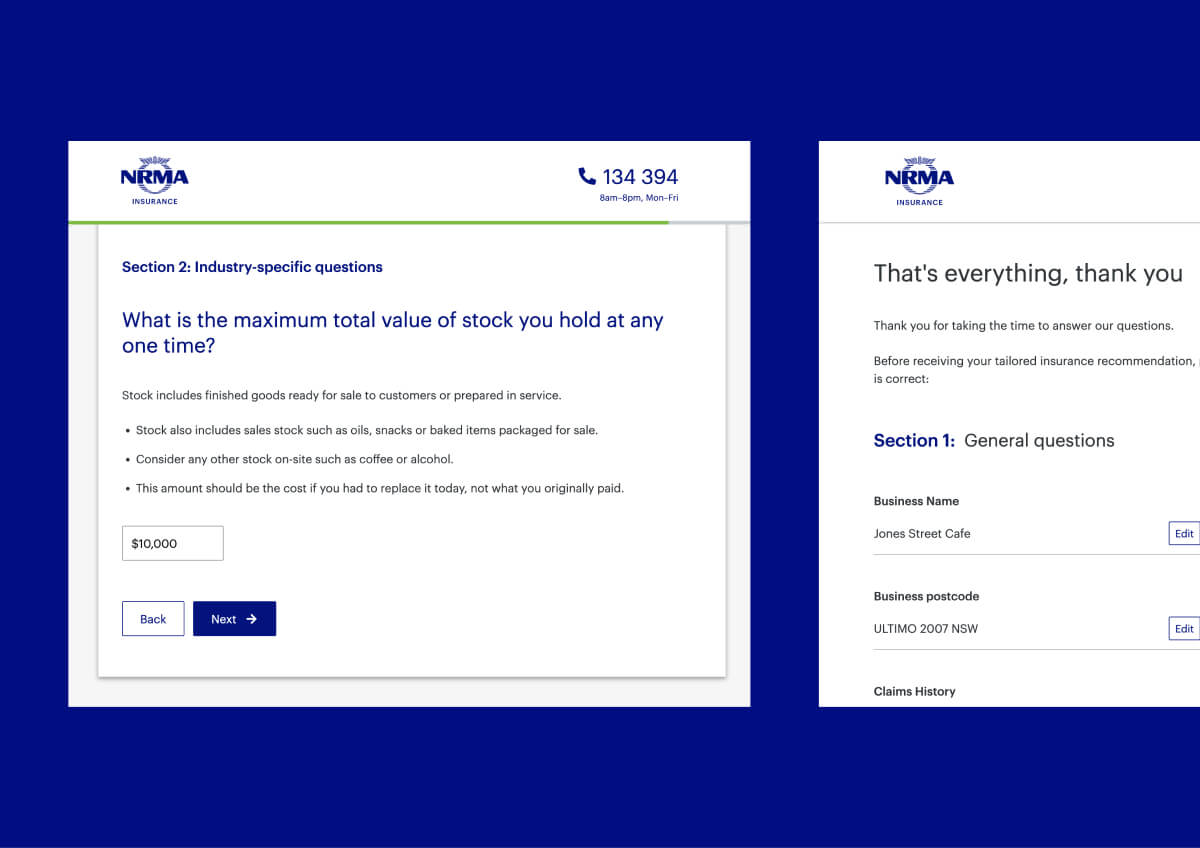

In response, we designed, developed and launched Australia’s first roboadvice insurance product.

Outputs

Links

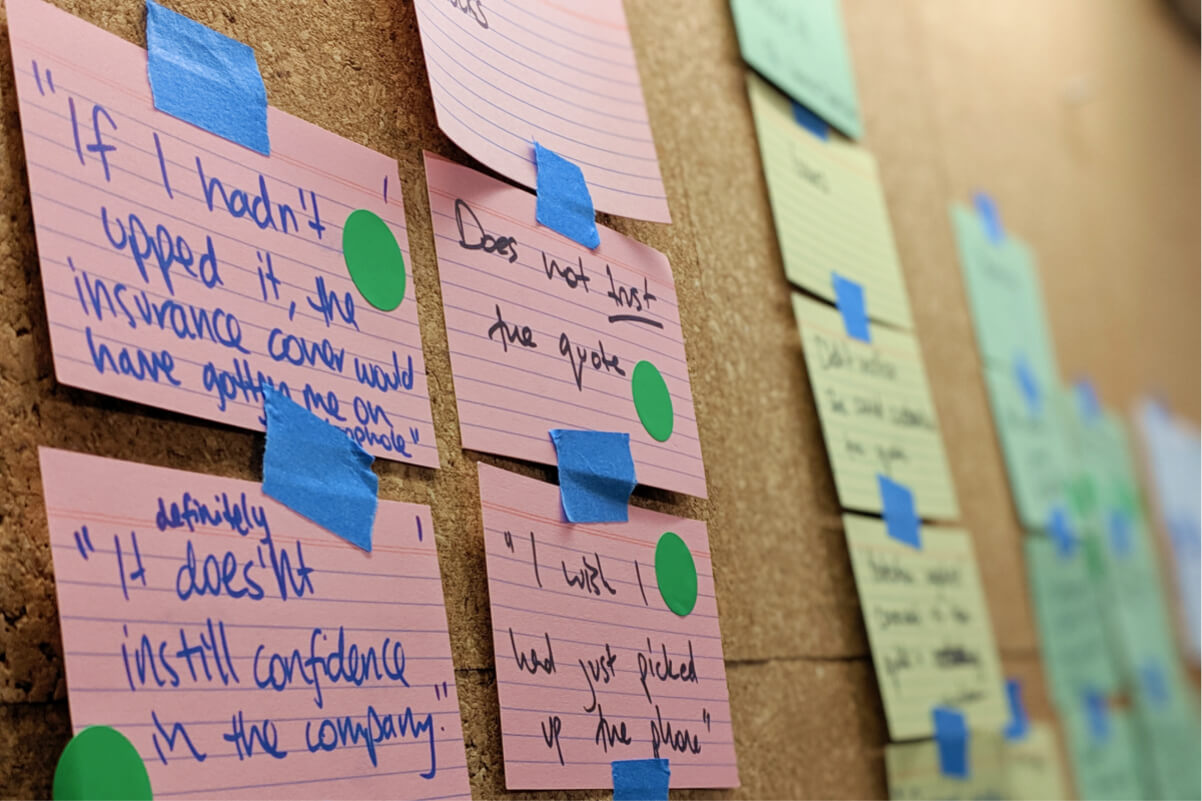

We first met with IAG (NRMA Insurance's parent company) to test the effectiveness of their chatbot tool. This bot was functioning as a live prototype with the intent to make it friendlier and easier for small business owners to shop online for business insurance. Testing it directly with business owners revealed a number of interesting things.

The pseudo-chat experience created frustration as users could only give information; not ask questions or clarify answers. The linear chat format is very inappropriate for things like error handling and guidance.

The pseudo-chat experience created frustration as users could only give information; not ask questions or clarify answers. The linear chat format is very inappropriate for things like error handling and guidance.

When users managed to progress to a review screen following chatting with the bot, a number of new concepts were introduced - insurance-specific terminology, types of insurance products, and overall a feeling of confusion.

What did begin to resonate however was the ability for small business owners to research and purchase business insurance in their own time, online.

The key to delivering insurance online is helping small business owners to make informed decisions.

What did begin to resonate however was the ability for small business owners to research and purchase business insurance in their own time, online.

The key to delivering insurance online is helping small business owners to make informed decisions.

Following testing and learning together as a blended team, we set out with a clear focus: if we don’t provide a way for business owners to meaningfully understand and engage with insurance recommendations, they remain unable to make decisions and access the right cover for their business.

For this to occur, we learned we must facilitate meaningful engagement with insurance recommendations using two ingredients - carefully balanced explanations of how each product worked, as well as examples of it in use across different business sectors. This allows small business owners to use expertise in their own business to access how applicable each product would be for their situation, and understand their own risk exposure.

For this to occur, we learned we must facilitate meaningful engagement with insurance recommendations using two ingredients - carefully balanced explanations of how each product worked, as well as examples of it in use across different business sectors. This allows small business owners to use expertise in their own business to access how applicable each product would be for their situation, and understand their own risk exposure.

I designed prototypes to test the riskiest assumptions - how accurately could we recommend insurance cover for each business, and what was necessary for users to feel confident enough to purchase online? Surprisingly, our early prototypes that focused on super accurate recommendations fell flat. Business owners didn't care that the calculation was accurate - they needed to know the 'why'.

We pivoted away from 'black box' recommendations, to providing a clear and relevant starting point recommendation that empowers users to cautiously make changes where appropriate. While this approach was certainly more difficult to navigate with legal teams and roboadvice regulation, everyone perservered as we could see the outsized impact it had on small business owners.

We pivoted away from 'black box' recommendations, to providing a clear and relevant starting point recommendation that empowers users to cautiously make changes where appropriate. While this approach was certainly more difficult to navigate with legal teams and roboadvice regulation, everyone perservered as we could see the outsized impact it had on small business owners.

“This is really cool, really good actually.

Last time I just trusted that someone else would do it for me. I got a quote and didn’t really participate in the process.”

Last time I just trusted that someone else would do it for me. I got a quote and didn’t really participate in the process.”

“These examples are things that can really happen… This [tool] seems honest, with no hidden agenda.”

Impact

Following the launch, 85% of algorithmically generated and recommended by Expert Advice have been purchased by small business customers; bringing it in line with purchase rates via human-assisted channels.

Following the launch, 85% of algorithmically generated and recommended by Expert Advice have been purchased by small business customers; bringing it in line with purchase rates via human-assisted channels.

Furthermore the average premium has doubled with Expert Advice - showing the small business owners are willing to purchase an appropriate level of cover when they are able to understand how it could be used in their business.